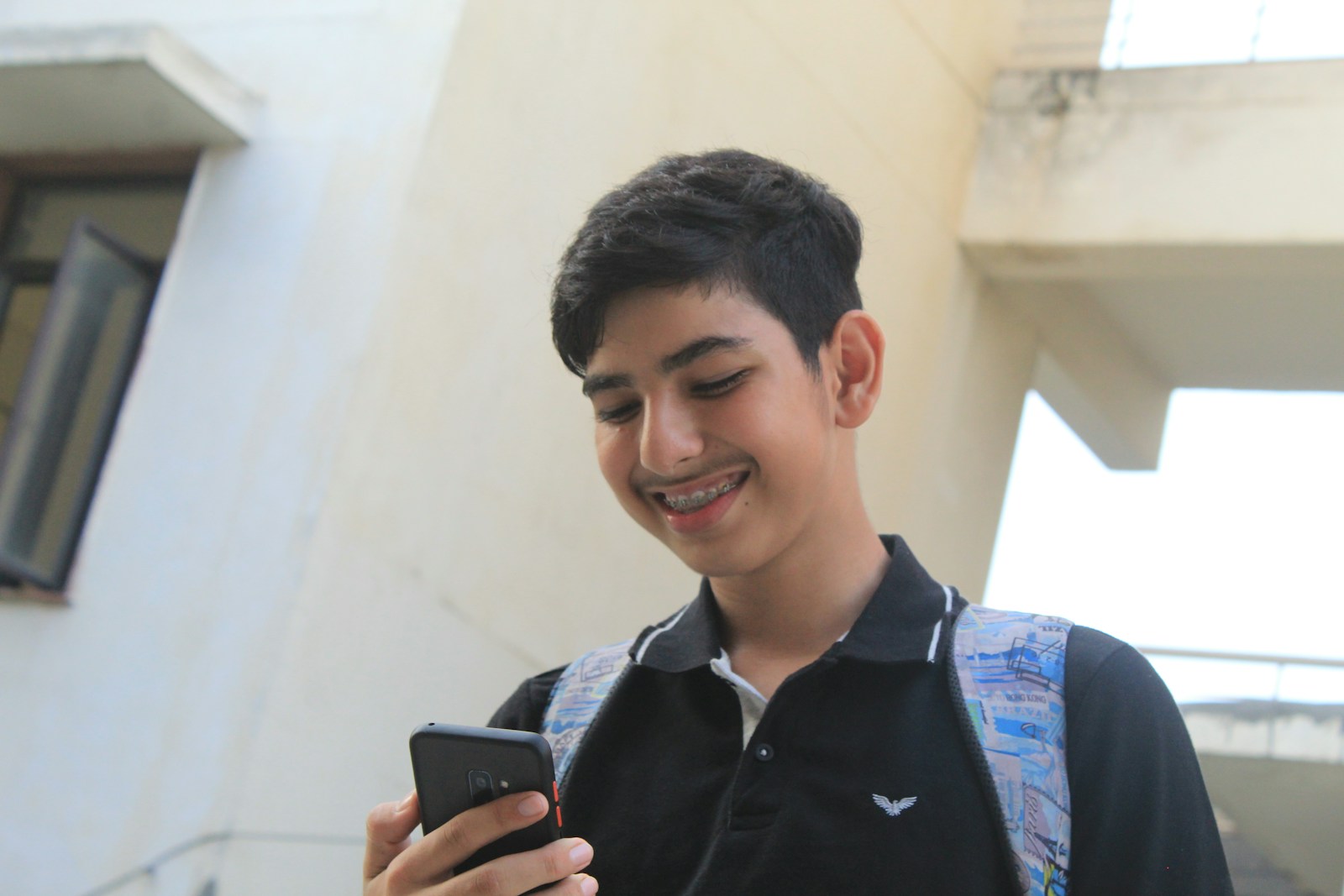

Teenage boys are statistically the most expensive drivers to insure. But if you’re a parent (or a student) looking to cut costs, good student discounts can offer serious savings—often between 10% and 25%. But how do you actually qualify?

Here’s a clear breakdown of how under-25 drivers, particularly teen boys in high school or college, can unlock good student discounts—and which insurers are most likely to offer them.

What Is a Good Student Discount?

A good student discount is a car insurance incentive that rewards students for maintaining strong academic performance. The rationale? Students who excel academically tend to be more responsible and less prone to risky driving behaviors.

Most major U.S. insurers offer this discount, and it usually applies to:

- High school students (typically 16+)

- Full-time college students (up to age 25)

- Unmarried dependents on a parent’s policy

Requirements: What Grades Do You Need?

Every insurer has slightly different requirements, but most follow these general guidelines:

| Insurer | Required GPA / Grade Level |

|---|---|

| GEICO | B average or better (3.0 GPA) |

| State Farm | Top 20% of class or B average |

| Progressive | B average or Dean’s List/Honor Roll |

| Allstate | Full-time student with 2.7 GPA or higher |

| Nationwide | B average or higher |

Proof accepted:

✅ Recent report cards

✅ Transcripts

✅ Signed forms from school administrators

✅ Official letters showing academic honors

Tips for Teen Boys: How to Actually Get the Discount

1. Maintain a B Average or Higher

Stay focused on your grades—even if you’re just meeting the minimum. A 3.0 GPA is the sweet spot.

2. Enroll Full-Time

Whether you’re in high school or college, you’ll need to be enrolled full-time to qualify. Part-time students typically aren’t eligible.

3. Use Honors Programs to Your Advantage

If you’re on the Dean’s List or Honor Roll, many insurers will accept that in place of a GPA.

4. Submit Proof Every Policy Period

Most insurers require re-submission of grades every 6 or 12 months. Set reminders so you don’t miss out.

5. Bundle with Other Teen Discounts

Pairing the good student discount with driver training or safe driving apps can amplify the savings.

Pros and Cons of Good Student Discounts

| Pros | Cons |

|---|---|

| ✅ Can save up to 25% on premiums | ❌ Requires academic consistency |

| ✅ Easy to qualify with effort | ❌ Needs re-verification every term |

| ✅ Available across most insurers | ❌ Only applies to full-time students |

| ✅ Encourages safer habits | ❌ Not available to part-time students |

Best Insurance Companies for Teen Drivers Offering Good Student Discounts

If you’re shopping for teen insurance and want companies that make it easier to save, consider these:

1. State Farm

- Great app-based telematics for young drivers

- Offers multiple teen-related discounts

2. GEICO

- Competitive premiums and good student options

- Digital proof upload makes it fast

3. Nationwide

- Includes discount in SmartRide and teen driver plans

- Transparent GPA requirements

4. Progressive

- Offers good student + distant student combo

- Parent monitoring tools included

5. Allstate

- Ideal for students already on Honor Roll

- Bundles well with parent policies

FAQs

Q1: Do college students still qualify for good student discounts?

Yes. Most insurers extend eligibility through age 25 if the student is full-time and unmarried.

Q2: Can I qualify if I take a gap semester or go part-time?

No. You must be enrolled full-time during the discount period to qualify.

Q3: Does attending community college or online school affect eligibility?

**No—**as long as you’re a full-time student at an accredited institution, you’re eligible regardless of the format.

You Might Also Be Interested In:

- Best Insurance Companies for Teen Drivers

- Does Car Color Affect Insurance Rates?

- How to Lower Your Car Insurance Premium

Let’s Talk Cars

Have a question? A suggestion? Just want to say hi?

You’re in the right place.

Use the form below to reach out to the AutoSpecs Daily team. We're happy to hear from readers, car lovers, first-time buyers, and anyone who's got something to share.

What can you contact us about?

- Feedback on one of our articles

- Ideas for new topics you'd like us to cover

- Questions about cars, gear, or general auto advice

- Media, partnership, or brand inquiries

- Anything else that's on your mind

We check every message that comes through and do our best to respond within 2 to 3 business days.

We don’t list an email address here to avoid spam, but the contact form is the best and fastest way to reach us.

Thanks for stopping by. We're glad you're here.