As more drivers tinker with electric vehicles (EVs) and push boundaries on performance, one fringe yet fascinating trend has quietly emerged: EV-to-hybrid conversions.

These involve modifying an all-electric car to include a gas-powered generator or small engine—essentially creating a DIY plug-in hybrid. But while the engineering is bold, the big question for most owners is: will your insurance company even cover a conversion like this?

In this guide, I’ll break down the realities of insuring a hybridized EV, what risks insurers look at, and whether these types of modifications are ever truly “worth it” from a coverage and safety standpoint.

What Is an EV-to-Hybrid Conversion?

Before diving into the insurance angle, let’s clarify what this conversion actually entails.

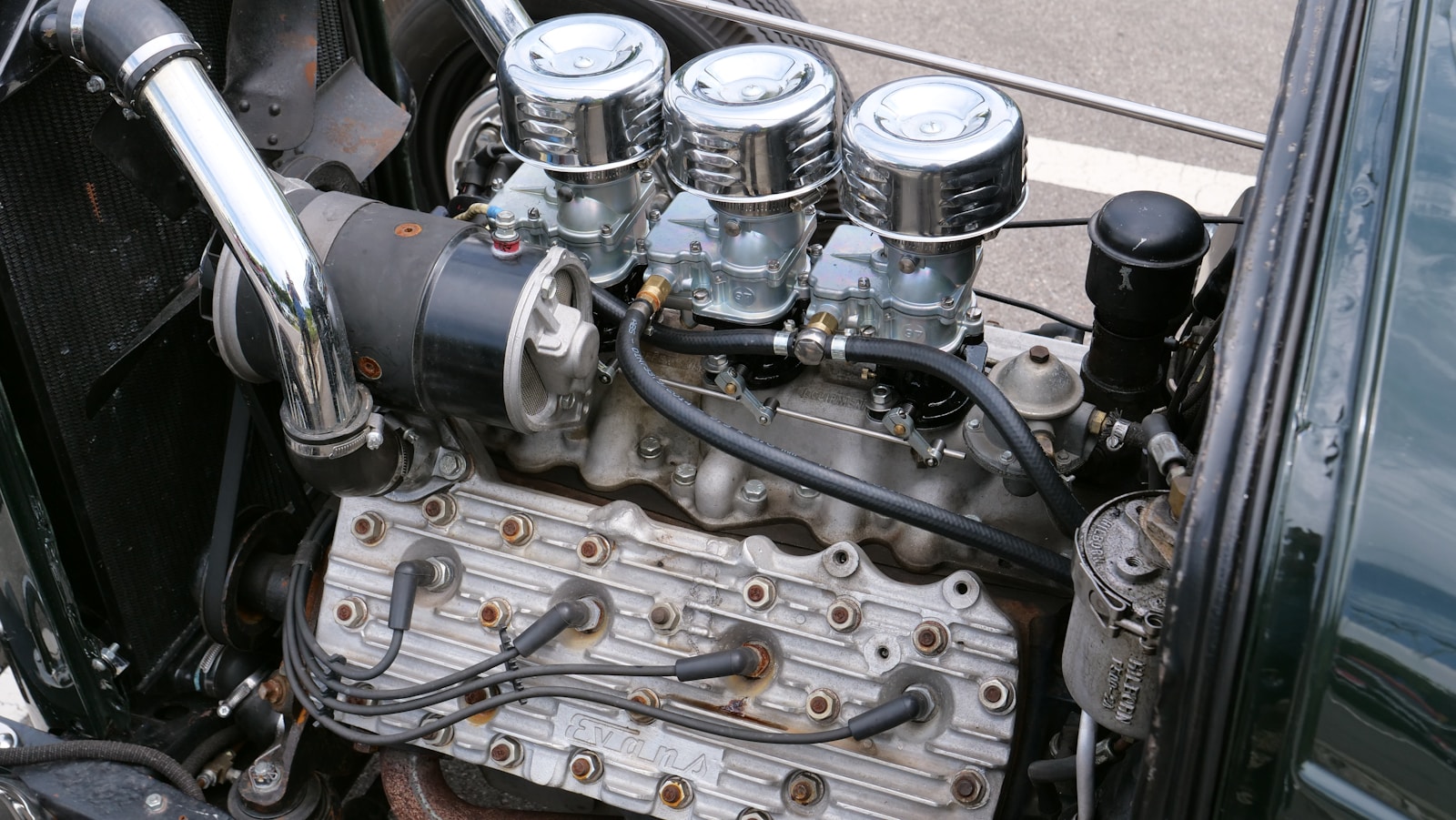

An EV-to-hybrid conversion typically means installing a small gasoline engine—often repurposed from a generator or scooter—that feeds power into the EV’s battery or even directly to the wheels. The result is a vehicle that can, in theory, extend range or drive during power outages or remote trips.

It’s a niche practice, usually done by tech-savvy DIYers who understand high-voltage systems and are willing to accept some risk in exchange for flexibility.

Why Would Anyone Do This?

Honestly? Because range anxiety is still real. Even with a growing charger network, long-distance travel in some parts of the country—especially in rural or mountainous areas—can be sketchy without a fast-charging option. Some owners feel more secure with a backup internal combustion system onboard.

Others just love the technical challenge. But if you’re doing this to save money long-term, tread carefully. Conversions can get expensive, and the insurance costs alone might offset any fuel savings.

How Insurance Companies View This Modification

Let’s be clear: insurance companies are risk managers, and unconventional modifications make their risk models panic.

Here’s what raises red flags:

1. Custom Powertrain Modifications

Installing an internal combustion engine into a car that was not designed for one is a major powertrain change. This alters the manufacturer’s design intent, potentially voids warranties, and increases liability if the vehicle causes an accident due to the mod.

2. Fire and Explosion Risk

EV battery systems are sensitive and complex. If a hybrid conversion is done improperly—or if incompatible fuel systems are introduced—you’ve now got fire hazards coming from two separate power sources. That’s a nightmare for underwriters.

3. Uncertified Labor and Equipment

Unless the conversion was done by a licensed upfitter and certified technician, insurers are likely to treat it as an “unprofessional” or hobbyist modification. That translates to either:

- Refusal to insure, or

- Denying future claims, especially if damage is related to the modification.

What Coverage Might Be Affected?

If you go through with a hybrid conversion, here’s what could be impacted:

🚗 Comprehensive and Collision Insurance

Most insurers will not automatically cover your modifications unless you’ve added “custom equipment coverage.” Even then, they’ll likely ask for receipts, specs, and photos.

If your conversion isn’t declared, your policy may be voided altogether.

🔧 Mechanical Breakdown Coverage

If you have extended warranties or MBI (mechanical breakdown insurance), consider them null and void. Powertrain alterations almost always disqualify coverage.

🔥 Liability Insurance

This is a gray area. If your converted vehicle is involved in a fire, injury, or accident caused by your mod, expect a deep investigation and a strong possibility of a denied payout—especially if they find evidence of negligence.

Can You Get Insurance for a Converted EV?

It depends.

Here’s how to increase your chances:

✅ Work With a Specialty Auto Insurer

Mainstream carriers like Geico or Progressive will almost always say no. But niche providers like Hagerty (for enthusiast vehicles) or American Modern may be more flexible—if the vehicle is road legal and appraised.

✅ Document Everything

Keep a complete log of:

- Parts used (with manufacturer details)

- Installation process

- Professional sign-off (if possible)

- Post-modification inspection reports

Some states also require you to title the vehicle as a “reconstructed” or “kit” car. That alone can make or break insurability.

✅ Get a Custom Equipment Rider

This rider increases the declared value of your vehicle to include modifications. Just know it won’t automatically protect you from liability if your mod causes damage.

Real-World Examples

🔧 DIYers on Reddit & YouTube

If you’ve followed EV modders online, you know the terrain. Some claim to have insurance without disclosing the conversion—risky if not outright dishonest.

Others have success by:

- Insuring the base vehicle normally

- Excluding the modification from coverage

- Using temporary insurance for off-road only use

🚓 Law Enforcement Stops

Multiple converted EV owners have reported issues at DMV inspections, emission checks (yes, even for hybrids), and even police stops—especially in stricter states like California or New York.

Bottom Line: Is It Worth It?

Let’s summarize the pros and cons:

| Pros | Cons |

|---|---|

| Emergency range backup | Difficult or impossible to insure |

| Technical learning opportunity | Voids warranty |

| Can be cheaper than OEM hybrids | Potential fire hazard |

| Useful in rural or blackout-prone areas | Reduced resale value |

| Can be legal with full disclosure | Liability risk in crashes |

Unless you’re deeply passionate about custom EV builds, have an off-road use case, or work with a specialty insurance provider, it’s usually not worth the risk.

FAQs

1. Will this affect my vehicle registration?

Yes. Most states require emissions and VIN inspections. If the mod changes emissions classification, you may need a reconstructed or custom title.

2. Will my standard insurance cover a fire caused by the conversion?

Not likely—especially if the mod wasn’t disclosed. Even disclosed mods may be excluded if they’re deemed too risky.

3. Can I revert the conversion later and get coverage back?

Technically yes, but it depends on how reversible the mod is. Some changes, like frame cutting or major wiring adjustments, may permanently affect the vehicle’s risk profile.

You Might Also Be Interested In:

- Are Used Electric Cars Worth It?

- Best Home Charger for Tesla Model 3

- What Is GAP Insurance and Do You Need It?

If you’re considering an EV-to-hybrid conversion, just know you’re not only playing with electricity—you’re playing with insurance fire too. Cool project? Absolutely. Easy to protect financially? Not so much.

Let’s Talk Cars

Have a question? A suggestion? Just want to say hi?

You’re in the right place.

Use the form below to reach out to the AutoSpecs Daily team. We're happy to hear from readers, car lovers, first-time buyers, and anyone who's got something to share.

What can you contact us about?

- Feedback on one of our articles

- Ideas for new topics you'd like us to cover

- Questions about cars, gear, or general auto advice

- Media, partnership, or brand inquiries

- Anything else that's on your mind

We check every message that comes through and do our best to respond within 2 to 3 business days.

We don’t list an email address here to avoid spam, but the contact form is the best and fastest way to reach us.

Thanks for stopping by. We're glad you're here.